Standard Deduction 2025 Single - What's the Standard Deduction for 2023 and 2025? Kiplinger, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). The standard deduction for a single person will go up from $13,850 in 2023 to $14,600 in 2025, an increase of 5.4%. Tax Deduction Brackets 2025 Mina Suzann, The 2023 and 2025 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the agi limit of 60% for cash donations for qualified charities. And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of $1,100 from the amount for tax year 2023.

What's the Standard Deduction for 2023 and 2025? Kiplinger, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). The standard deduction for a single person will go up from $13,850 in 2023 to $14,600 in 2025, an increase of 5.4%.

The 2025 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900.

Tax Brackets 2025 Irs Single Elana Harmony, Standard deduction and personal exemption. Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and/or blindness.

Standard Deduction Vs Itemized 2025 Twila Ingeberg, The top marginal tax rate in tax year 2025, will remain at 37% for single individuals with incomes greater than $609,350. The 2025 standard deduction for head of household is $21,900.

The 2025 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900.

How to complete your W4 form in 2025 (2023), 2025 irs tax brackets, standard deductions. By comparison, the most recently vetoed tax relief package would have cost less than $2.4 billion over five years, meaning even if state revenues remain stagnant for each of the next five years, the state.

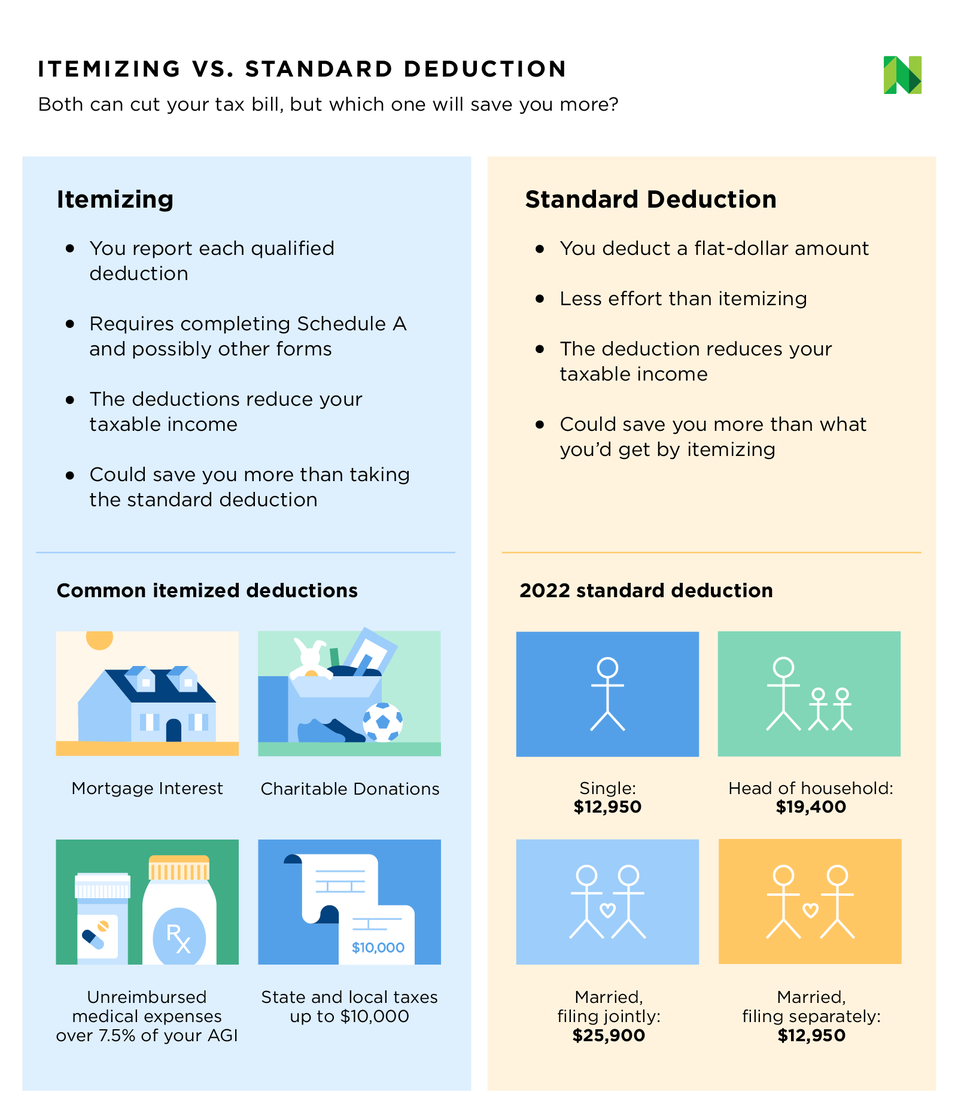

Itemized deductions can also reduce your taxable income, but the amount varies and is not. The 2025 standard deduction amounts are as follows:

Tax Brackets 2025 Single Orel Tracey, Irs announces 2025 tax brackets, updated standard deduction. $14,600 for married couples filing separately;

2025 Tax Brackets And Deductions Cody Mercie, You will be taxed $10,969. The 2025 standard deduction for qualifying surviving spouse is $29,200.

2025 Tax Brackets And Standard Deduction Edee Bettine, New construction homes sold at an average of $1.74 million in san jose, ca. The top marginal tax rate in tax year 2025, will remain at 37% for single individuals with incomes greater than $609,350.

Standard Deduction 2025 Single. The 2025 standard deduction for qualifying surviving spouse is $29,200. Your average tax rate is 10.94.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)